A PRIVATE INVESTMENT FIRM PROVIDING CAPITAL & RESOURCES TO COMPANIES THAT ARE POISED FOR ACCELERATED GROWTH

Gaston Capital was founded in 2006 with a simple objective of finding and supporting companies that possess great potential. Our founder believed that innovation and hard work alone aren’t enough to make companies great. Truly great companies also need strong leadership, a disciplined approach to growth, and unwavering support from its financial sponsors. Gaston Capital seeks to invest in companies that are driven to be great.

WHERE DRIVE AND DISCIPLINE MEET

Gaston Capital makes meaningful minority investments in growth companies that are primarily located in the United States. We invest with the belief that businesses should generate positive investment return in addition to making a positive impact in the world. We support high-integrity entrepreneurs with a collaborative approach to creating value that leverages our experience and network. Gaston Capital aligns its interests with its portfolio companies’ goals to achieve the best possible results. We provide thoughtful capital without artificial time constraints to achieve superior outcomes. Industries of particular interest include business services, healthcare, light industrial, SaaS, and financial services. Read more about our investment below.

Partner Feedback

Working with Gaston Capital has benefited Bold Therapeutics not only in funding our progress, but we rely on their leadership and participation in key decisions, as well.

Since their first investment, Gaston Capital was extremely supportive of our management team’s plan for growth. We created a true partnership without which our significant growth and outstanding results wouldn’t have been possible.

Direct Investments to Fund Growth

Gaston Capital is dedicated to investing in businesses with solid fundamentals and disciplined management teams that have a vision for growth and value creation. We focus on select industries that provide opportunities for exceptional growth, both organically and through strategic acquisitions. Most importantly, we invest in people who are aligned with our core values of commitment, integrity, partnership, and respect. Gaston Capital believes that collaborating with proven management teams who share our values will result in superior outcomes for all involved.

We look for investment opportunities where we can fill a capital void for high-growth companies. Gaston Capital is a growth equity investor that participates on a standalone basis or as a co-investor alongside reputable investors. We target cash-flow positive companies competing in disruptive industries.

Investment Criteria

- Platforms headquartered in the United States

- Exceptional Management teams in a high growth industry

- EBITDA above $1 million

- Investment size: $2-10 million

- Focus industries include healthcare, business services, financial services, light industrial, SaaS

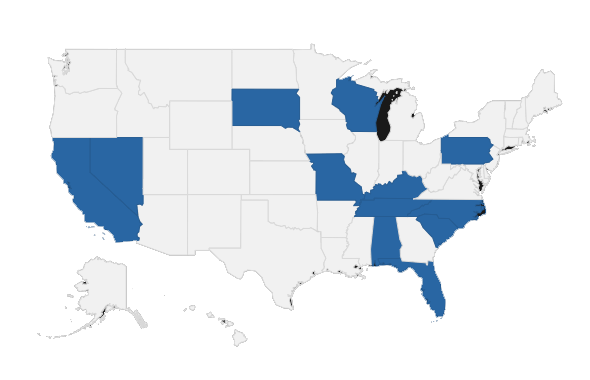

Where we have invested

Our Team

Michael K. (Mick) McMahan

Boards

- Enviro-Master, Inc.

- SMRxT, Inc.

- Cross Country Transportation Group

Education

- B.A. University of North Carolina (Chapel Hill)

- M.P.A. University of North Carolina (Chapel Hill)

Glenn Walthall

Boards

- Bold Therapeutics, Inc.

- Enviro-Master, Inc.

- Intezyne Technologies, Inc.

- Mobility Designed, Inc.

Glenn serves as the firm’s Managing Partner. His career spans thirty years as a venture capitalist, investment banker, bank executive and consultant. Glenn is currently the Chairman of Bold Therapeutics, and Intezyne Technologies, and a board member of Enviro-Master International, SMRxT, and Mobility Designed. He resides in Charlotte (NC), and has a BS and MBA from Virginia Tech.

Education

- B.S. Virginia Tech

- M.B.A. Virginia Tech

Don joined Gaston Capital as a Partner in 2018 after 17 years at Eaton Vance Corporation, where he served as Vice President, Regional Director. Don has raised over $5 billion in Private Placements, SMA, and 40 Act Funds. He is currently a board member of Mobility Designed and received his BS from Chapman College and MBA from Pepperdine University.

Education

- B.S. Chapman College

- M.B.A Pepperdine University

Kyle joined Gaston Capital in 2024 as a Senior Associate, where he evaluates new investment opportunities and monitors portfolio companies. Prior to joining Gaston Capital, Kyle was an Associate at Five Points Capital and an Investment Banking Analyst at Leerink Partners. He received his BBA in Finance from the University of Wisconsin Oshkosh.

Education

- B.B.A. Finance, University of Wisconsin Oshkosh

We invest in growth

News

Contact Us

Contact Information

We’d love to hear from you!

-

2115 Rexford Road

Suite 400

Charlotte, NC 28211 - (704) 318-2780

-

1104 Spruce Street

Suite 100

Belmont, NC 28012 - (704) 461-8883